【战绩】 吴老师分享PCCS 靠谱

陈日庆(42岁)是一个工程师。工程师总是追求准确性,

正月3日,下午5时零9分,陈日庆收到吴老师的短讯分享PCCS 当天此股以 0.235 收市。

陈日庆翌日便以 0.24买入 50张。当天此股就跑了,以0.265收市!

正月5日,此股以0.27 开出。最高挂 0.305.收市挂 0.30!

虽然陈日庆认为此股仍有上升空间,但他不想持票,遂以0.30 套利离场,净赚RM2,792,回酬率23.10%!

这是吴老师在《搭炒家顺风车》群组的分享 ,如果你还没有参加《飙股兵法网》群组,请先 加入《飙股兵法网站》成为会员,赚到钱之后,才参加《

有兴趣成为会员者,请联系吴老师012-6597910。www

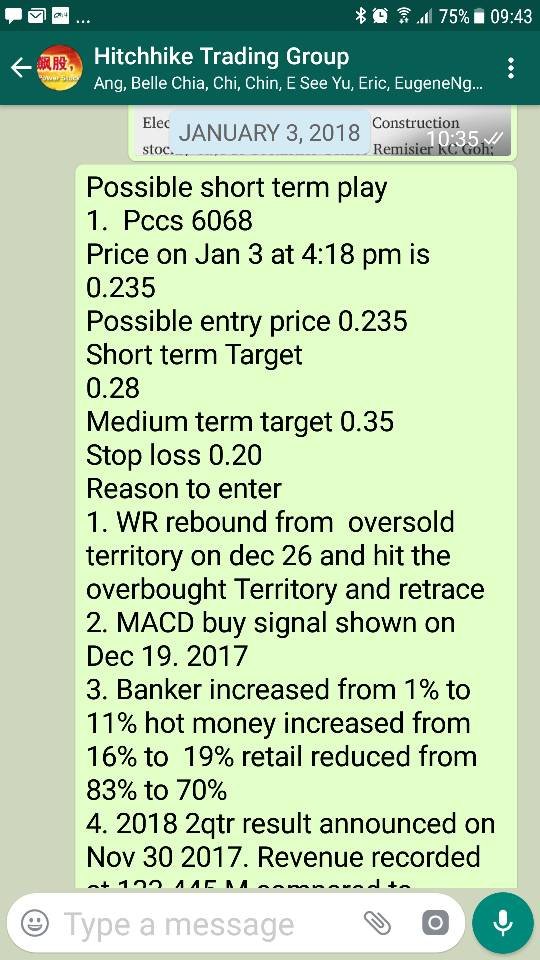

Possible short term play

1. Pccs 6068

Price on Jan 3 at 4:18 pm is 0.235

Possible entry price 0.235

Short term Target

0.28

Medium term target 0.35

Stop loss 0.20

Reason to enter

1. WR rebound from oversold territory on dec 26 and hit the overbought Territory and retrace

2. MACD buy signal shown on Dec 19. 2017

3. Banker increased from 1% to 11% hot money increased from 16% to 19% retail reduced from 83% to 70%

4. 2018 2qtr result announced on Nov 30 2017. Revenue recorded at 133.445 M compared to 2017 2qtr’s revenue recorded at 118.407 up 12.7%. Net profit recorded at 1.188 M compared to net loss of 6.341 M, up 118.74%.

5. 2018 3qtr result is expected to announce on Feb 28 2018.

COMMENTARY ON PROSPECTS in the 2018 2nd qtr report.

Apparel Division

The Board is of the view that the overall growth momentum will likely cool in Malaysia, Cambodia

apparel is expected to improve whereas China apparel will continue its strong growth momentum

in the third quarter.

Labelling Division

The Board is cautiously optimistic the labelling will maintain their positive financial performance

in the financial year ending 31 March 2018 due to projected growth from continuing demand in

Malaysia whereas the labelling business in Cambodia remain challenging.

Other Division

The Other division’s performance remains challenging but the positive outlook of Cambodia

apparel expected for this laggard to play catch-up.

Management will continue to focus on improving operational efficiencies and controlling its

operation expenses to remain competitive in this challenging environment.

Barring unforeseen circumstances, the management will endeavour to achieve a satisfactory

result for the financial year ending 31 March 2018.

(Trade at your own risk=TAYOR)

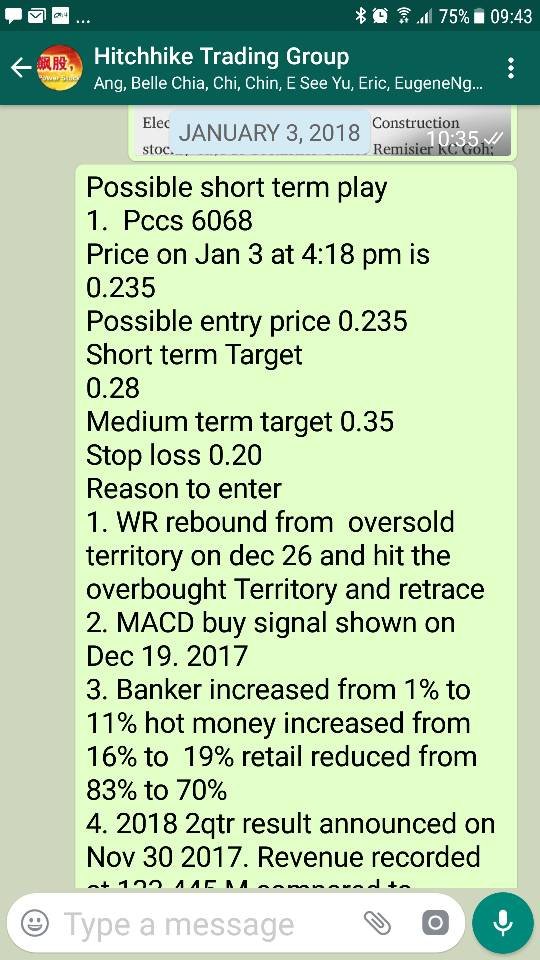

1. Pccs 6068

Price on Jan 3 at 4:18 pm is 0.235

Possible entry price 0.235

Short term Target

0.28

Medium term target 0.35

Stop loss 0.20

Reason to enter

1. WR rebound from oversold territory on dec 26 and hit the overbought Territory and retrace

2. MACD buy signal shown on Dec 19. 2017

3. Banker increased from 1% to 11% hot money increased from 16% to 19% retail reduced from 83% to 70%

4. 2018 2qtr result announced on Nov 30 2017. Revenue recorded at 133.445 M compared to 2017 2qtr’s revenue recorded at 118.407 up 12.7%. Net profit recorded at 1.188 M compared to net loss of 6.341 M, up 118.74%.

5. 2018 3qtr result is expected to announce on Feb 28 2018.

COMMENTARY ON PROSPECTS in the 2018 2nd qtr report.

Apparel Division

The Board is of the view that the overall growth momentum will likely cool in Malaysia, Cambodia

apparel is expected to improve whereas China apparel will continue its strong growth momentum

in the third quarter.

Labelling Division

The Board is cautiously optimistic the labelling will maintain their positive financial performance

in the financial year ending 31 March 2018 due to projected growth from continuing demand in

Malaysia whereas the labelling business in Cambodia remain challenging.

Other Division

The Other division’s performance remains challenging but the positive outlook of Cambodia

apparel expected for this laggard to play catch-up.

Management will continue to focus on improving operational efficiencies and controlling its

operation expenses to remain competitive in this challenging environment.

Barring unforeseen circumstances, the management will endeavour to achieve a satisfactory

result for the financial year ending 31 March 2018.

(Trade at your own risk=TAYOR)